The 60/40 plan is our solution to the challenges and extra tax burden faced by landlords in the private rental sector imposed by Section 24. If you are not familiar with these challenges and their implications, please read over our Section 24 Article.

So what is the solution?

Firstly we need to define the problem, which is simple yet has massive implications. The problem is one of reduced or eliminated cashflow. This has several effects:

- Vastly reduced net yields

- Possibly negative cashflow

- Return on Investment eliminated

- Pressure to sell up and leave the property sector with the consequent loss of an appreciating capital asset, which many landlords are relying on for their retirement.

So it can be said that the main effects that Section24 will have on the private rental sector (and the majority of landlords and investors who make up this sector) are on:

- Income

- Capital appreciation

- The ‘shape’ of the sector

The final point, the ‘shape’ of the sector is an effect that has been predicted by ARLA, the NLA and larger Estate Agents such as Belvoir and Countrywide, in that the changes will force a large proportion of smaller private investors out of the market, who will be forced to sell to larger corporate investors. Supply will be reduced due to decreased purchase levels thanks in large part to the increased Stamp Duty and uncertainty in the market, and rents will inevitably increase to tenants. In fact, the leading campaign against Section24 was called ‘Stop The Tenant Tax!’ as this was seen to be an inevitable consequence.

Click here to read an analysis of the issues presented by Section 24 from Property 118.

What is the 60/40 plan?

The 60/40 plan is a way to put your property investment in a legal structure that is exempt from the increased tax burden imposed on private property owners by Section24. So the problems above are minimised or totally negated.

- Maintain positive net yields

- Maintain positive cashflow

- Maintain return on investment

- Keep the benefits of capital appreciation over time, so maintaining that pension fund.

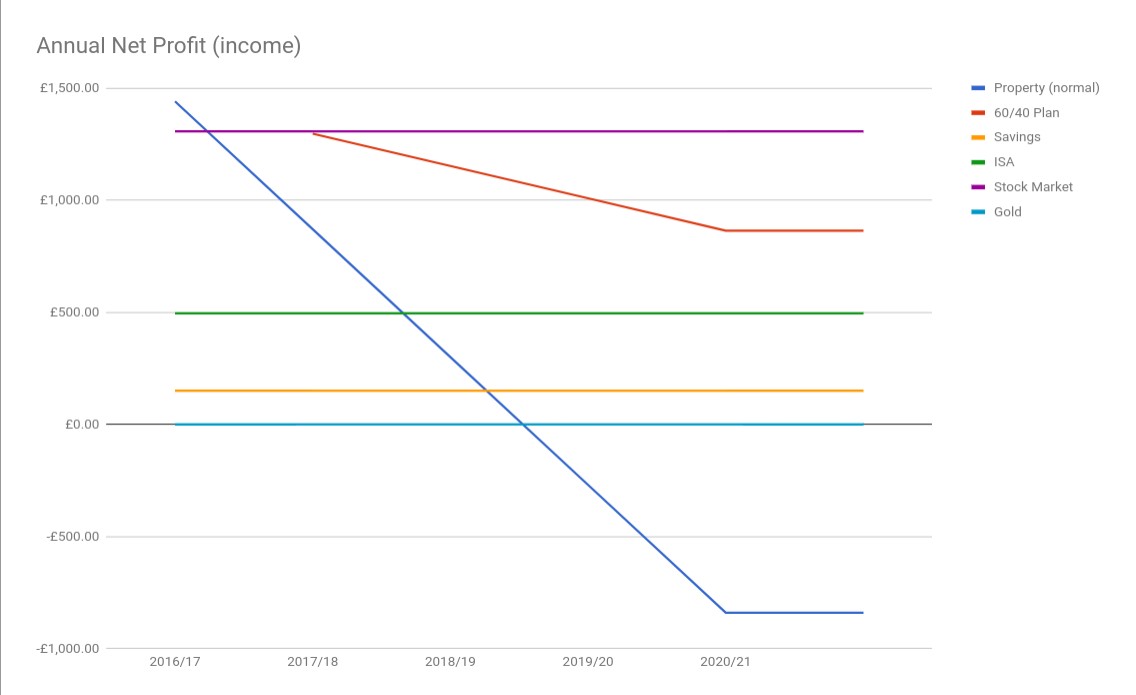

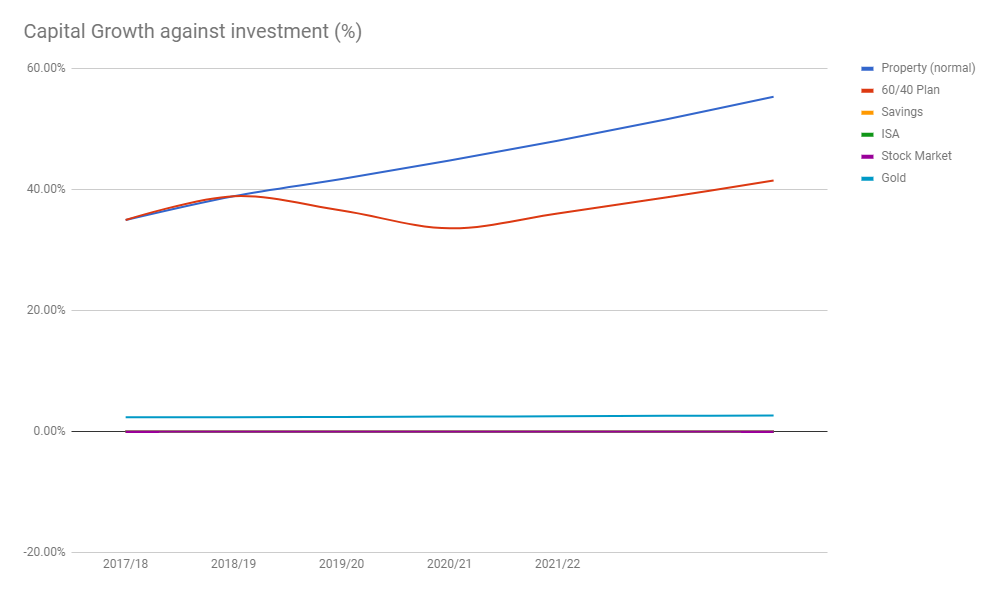

Although it is unlikely the figures will be as good as the cashflow, yields and ROI prior to April 2017 when Section24 came into effect, the income and benefits of capital appreciation are still significantly higher than other investment models with a similar low-level of risk. Investing in the stock market of foreign exchange market can be arguably more lucrative, but carry a significantly higher risk to your investment. A recent study showed that the average gains on the stock market over the last 20 years for a a fixed portfolio are around 4.36% per annum, which is lower than the average property value increases (between 7.6% and 11.5% depending on which Index you follow), and you either get the capital increase or income, not both, which you do from property.

Take a look at the graphs below to see a comparison of investment vehicles (the calculations and basis for these graphs are available here).

As you can see, there is still no other investment vehicle that comes close to property for its capital appreciation, and your maximum benefit would be to own the property outright. Your capital benefits are slightly reduced with us, but it does mean you can afford to stay in the property market to see these benefits due to the preservation of net income and cashflow.

Why are we doing this?

Because it allows private landlords and investors to remain in the private rental sector, enjoying the benefits of regular rental income and capital appreciation unique to the property market without being forced to sell their interest in their properties and leave the sector.

How does it work?

You sell your property into our company structure for 40% below its current market value, exempt from the restrictions of Section24.

For that, you enter into a Joint Venture contract with the company to entitle you to a set proportion of all profits from rental income, refinance and sale of your property. This proportion you get is 60% - hence the name 60/40 plan.

Because you are entering into a contract for a profit share in regards to your property, you are not really selling the property in the traditional sense as you are maintaining a majority interest you investment (60%), you are effectively transferring your investment into a more tax efficient structure.

Not only that, but as you know the Section 24 tax increases are being phased in at 25% a year until 2020, so we have decided to do the same, phasing in our share. So up to April 2018 we only get 10% of profits (you get 90%), from April 2018 to April 2019 our share increases to 20% (you get 80%). April 2019 to April 2020 you get 70% and then 60% from April 2020.

Compare this to HMRC’s share under Section 24, which over the same period could be demanding around 30%, 50%, 70% and 90% (in some cases over 100% - you pay to keep your property) and we think we’ve found the fairest and best way for small investors and landlords to remain in property.

This means you are guaranteed to earn more rental income than if you were to hold off until Section 24 becomes fully implemented. It also addresses a concern among landlords that their property will be ‘flipped’, or immediately sold on for a quick profit as there is very little incentive to do this until at least 2021. From there, any accountant will tell you that an appreciating asset with a positive cashflow is something to hold on to. The only reason to sell that we can see is for the ‘usual’ reasons of tenancy voids. We use local managing agents and take out full insurance on properties to ensure this does not happen, but if it does, as a stakeholder, you will be consulted at every stage and given full accounts to ensure your contractual right are maintained.

How do I know its right for me?

If you meet any of the following criteria, there is a strong chance this could be the right solution for you.

- You are a private landlord or have a second property you rent out

- You submit your tax return to HMRC via Self-Assessment

- You are a higher-rate income tax payer, or close to the income threshold (£45k)

- You have single or family lets

- You have a portfolio of 5 or fewer properties

- Your net yield is less than 15%

Of course, these are only guidelines, so if you think this might be the right thing for you, we would be delighted to provide you with a calculation based on your specific figures you can take to your accountant for comparison.

Alternatively, if you have a Facebook account, click on the button in the box below to sign up to our interactive tutorial, which includes a Healthcheck and Calculator.