If you are a private landlord in the UK, your income tax could have already gone up by over 60%. Not only that, but further rises mean that over the next four years, your income tax bill could treble or even quadruple. There is one piece of legislation that is responsible for this; Section 24 of the Finance (no.2) Act 2015.

It doesn’t sound too exciting, but this piece of law, coined as the ‘Tenant Tax’ by campaign groups, is possibly the biggest change to lettings and property investment in a generation, and yet is has been passed into law and brought in with hardly any fanfare, with protests by the likes of ARLA, the NLA and Belvoir falling on deaf ears.

So what is it? Put simply, it is a piece of law that stops private landlords being able to offset loan interest payments against rent for income tax purposes.

To be more accurate, interest payments made against loans (including bridging finance, mortgages or home improvement loans) on any property that isn’t your primary residence, so second homes and, more importantly, investment properties, will stop receiving higher rate tax relief and will instead attract a 20% rebate, starting in April 2017 and reaching full effectiveness in April 2020. The good news is that if you are a lower rate income tax payer, there will be no effect from Section 24, as the current income tax relief lost will be exactly matched by the new rate of relief. This comes with a warning though, if you are close to the £45k threshold, the way Section 24 changes the way income tax is calculated means that your taxable income could rise significantly, so pushing you into the higher rate income tax band.

The easiest way to illustrate this is with an example.

John is a private landlord with two properties, for which he gets a total rental income of £1500 every month. His management and other costs average £350 per month, and his mortgage costs are £950 per month.

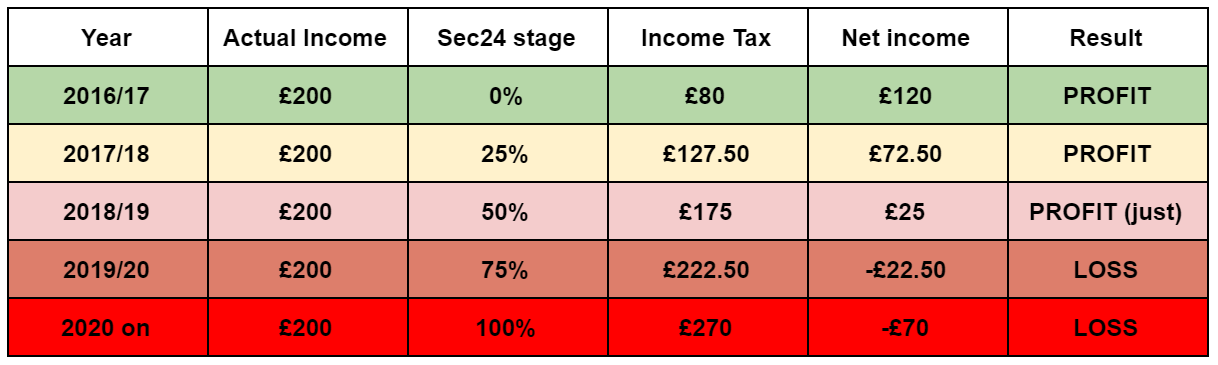

He is used to getting a monthly income of £200, and is happy to pay £80 of that to HMRC in income tax, which means his final monthly profit after tax is £120.

But, starting in April 2017, he has only been able to claim back 75% of his mortgage against full rate tax, The other 25% only attracts a basic 20% relief. So, he’s still getting his £200 before tax. HMRC, however, HMRC have reduced his relief on interest payments down from £380 (40% of his £950 interest payments) to £332.50. His income tax goes up from £80 to £127.50

From April 2018, still getting his £200, his tax has almost matched his income, and he is now paying £175 a month to HMRC. But it doesn’t stop there, 2019/20 sees him paying £222.50 per month. From 2020/21 he is paying £270 a month income tax on an actual income of £200. In other words, he is paying £840 a year to stay in property.

This has left the industry in somewhat of a quandary, especially for smaller private landlords who submit their accounts to HMRC using self-assessment. The larger corporates are not liable for these tax changes, so it is the smaller landlords (who account for over 80% of the private rental sector) who are losing out.

But they needn’t. We have been doing some research to try to find a way through this for landlords, who are being faced with a hobson’s choice of incorporating, changing their investment model for possibly higher yields but hugely increased risk, or selling up and leaving the sector for good.

We have found a way that landlords can stay in the sector and still benefit from the rental incomes and capital appreciation that the corporates enjoy, just by changing the investment model.

In John’s case above, by doing nothing he will be making a £70 loss every month. If he contacted us, he could be making a profit of £72 a month and keep an interest in the property so when it is sold or refinanced, he gets the benefits of capital growth.

In certain cases, we can actually increase the income from your property, making it more profitable than it was before. Yield and return on investment figures are also still comfortably more than those offered by other investments like the stock market or precious metals.

Please note the figures used are an illustration, but are as realistic as we can make them. Click here to see how we worked this out. For a fuller explanation of the 60/40 plan and how it can help protect your investment click here.

For a pdf document on Section 24 and the failed campaign to overturn it, click here (source: Property118)